| Good morning. | The Fast Five → Another lull, but fireworks are coming, Trump presses China to make tariff offer, Nvidia faces $5.5B charge tied to China chip sales, OpenAI considering its own social network, and Ryan Cohen ramps Up $1 billion GameStop bet… | 🔑 Unlock Potential Gains in Volatile Markets With This Historic Breakthrough * | | Calendar: (all times ET) - Full Calendar | | Your 5-minute briefing for Wednesday, April 16: | BEFORE THE OPEN |  | As of market close 4/15/2025. |

| Pre-Market: | | |

|

| US Investor % Bullish Sentiment:

↑ 28.52% for Week of April 10 2025 |

|

|  | Previous week: 21.76%. Updates every Friday. |

| | Market Wrap: | Futures drop: Dow -328 pts (-0.8%), S&P -1.5%, Nasdaq -2.3%. Nvidia -6% after $5.5B China export charge. Tuesday: Dow -0.4%, S&P -0.2%, Nasdaq slightly lower. Retail sales due Wed (est. +1.2%); also watching industrial data.

|

|

| | | | | | | | | | Trading Through Today's Unstable Market | | Imagine foreseeing a 30% stock jump — to the day — weeks before it happens. | Introducing a new way to predict the biggest stock jumps in today's volatile market, to the day, with 83% backtested accuracy. | |

| |

| | |

| | | |  | Investors enjoyed another day of much-needed rest and recuperation on Tuesday after the last few bruising weeks. |

|

|

| | |  | President Trump called on China to reach out to him in order to kick off negotiations aimed at resolving the escalating trade fight between the world's two largest economies. |

| Wall Street ends down slightly; tariff uncertainty keeps investors on edge (more) Retail investors who've only known bull markets are buying the dip (more) Trump orders tariff probe on all US critical mineral imports (more) Gold hits record high on weaker dollar (more) China's economy grew by 5.4% in first quarter of 2025 (more) US issues export licensing requirements for Nvidia, AMD chips to China (more) Nvidia faces $5.5B charge as US restricts chip sales to China (more) Ryan Cohen ramps Up $1 bln GameStop bet with margin loan (more) Elliott builds over $1.5 bln stake in HP Enterprise (more) OpenAI considering its own social network to compete with Elon Musk's X (more) Hermes overtakes LVMH to become most valuable luxury company (more) Figma files for IPO more than a year after ditching Adobe deal (more)

|

|

| | | M+A | Investments | | VC | Mainspring, a linear generator products company, raised $258M in financing Virtue AI, a privacy-preserving AI systems company, raised $30M in Seed and Series A funding Well, an AI-driven health engagement company, raised $30M in additional funding IUNU, a provider of AI and machine vision technologies for the agricultural sector, raised $20M in funding Doss, an AI-powered ERP and data platform, raised $18M in Series A funding Loti AI, a leader in likeness protection technology, closed a $16.2M Series A funding Corvic AI, a data-centric AI cognitive infrastructure company, raised $12M in Seed funding Liminal, a real-time intelligence platform for complex markets and regulated industries, raised $8.5M in Series A funding Friday Harbor, an AI-powered platform that helps loan officers assemble complete and compliant loan files in real time, raised $6M in Seed funding TheStage AI, a deep tech startup, raised $4.5M in funding Ideem, a company specializing in online payments, raised $2.4M in Seed funding QWERKY AI, a human-centered AI company building AI tools, raised $2M in Seed funding

|

|

| | | China selling seized crypto to top up coffers as economy slows (more) Bitcoin slips with XRP, ADA as Nvidia's massive $5.5B charge sours investor sentiment (more) Semler Scientific settles DOJ probe, says ready to buy more Bitcoin (more)

|

|

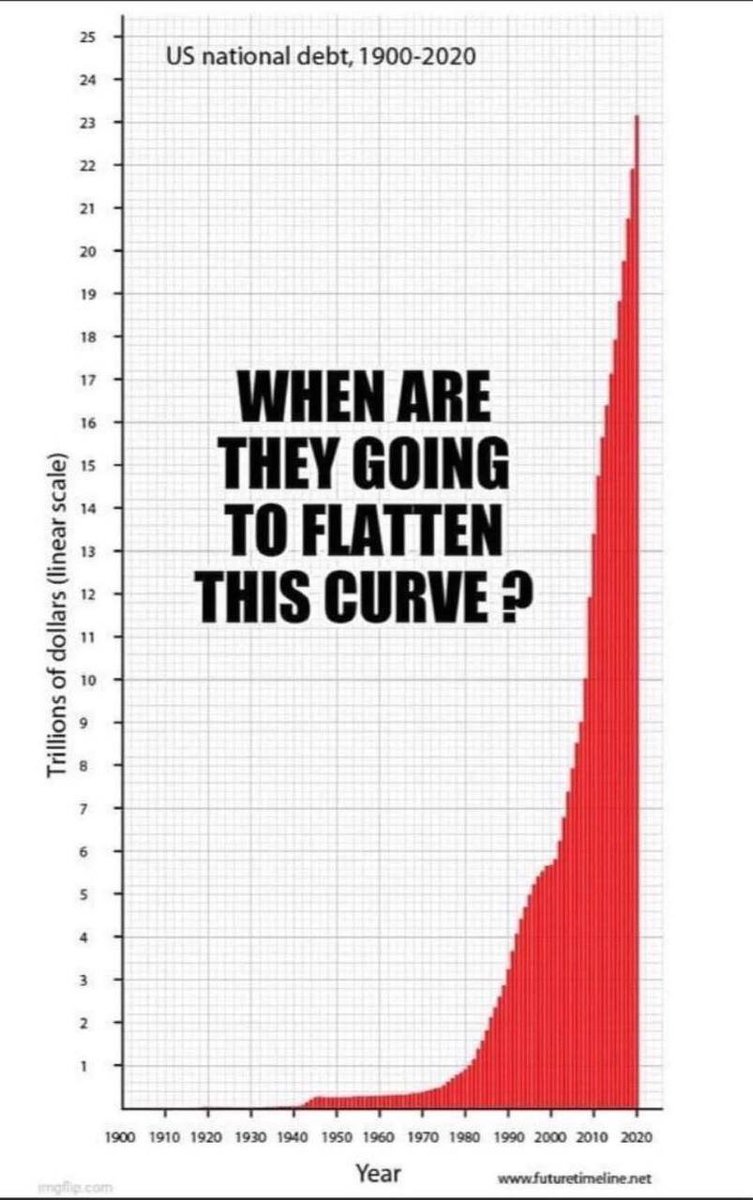

| | | | | |  | BuccoCapital Bloke @buccocapital |  |

| |

| |  | | | 7:17 PM • Apr 15, 2025 | | | | | | 905 Likes 39 Retweets | 28 Replies |

|

| |  | Wall Street Mav @WallStreetMav |  |

| |

When? | |  | | | 5:45 AM • Apr 16, 2025 | | | | | | 112 Likes 12 Retweets | 44 Replies |

|

| | | | *sponsored message | Disclaimer: Market Briefing© is a news publisher. All statements and expressions herein are the sole opinions of the authors or paid advertisers. The information, tools, and material presented are provided for informational purposes only, are not financial advice, and are not to be used or considered as an offer to buy or sell securities; and the publisher does not guarantee their accuracy or reliability. Please conduct your own research and consult an independent financial adviser before making any investments. Neither the publisher nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein. Assets mentioned may be owned by members of the Market Briefing team. | |

|

No comments:

Post a Comment